The characteristics of the current market sell-off have been extreme

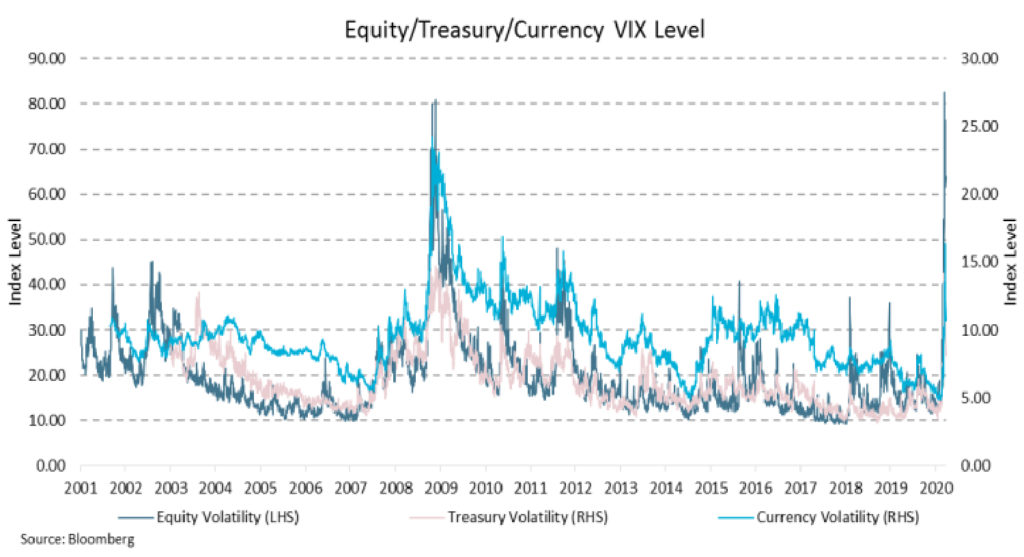

The extent of the decline in markets we have seen through March to date has resulted in the quickest and sharpest fall into a bear market investors have ever witnessed. Whilst the absolute magnitude of the declines so far are in line with many historical event-driven bear markets, the key differences this time has been the speed of decline. Considering the US S&P 500 Index peaked the week of the 17th of February, it has only taken 16 trading sessions for the index to be down 20%, almost twice the speed of the prior fastest recorded crash of 1929 (see figure 1a.). Volatility has also been a differentiator with the VIX index (a measure of market volatility) recently hitting an all-time high, surpassing even the highs experienced through the 2007/08 financial crisis. Last week there were three consecutive days of moves +/- 9% in magnitude for the S&P 500, the first time since 1929.

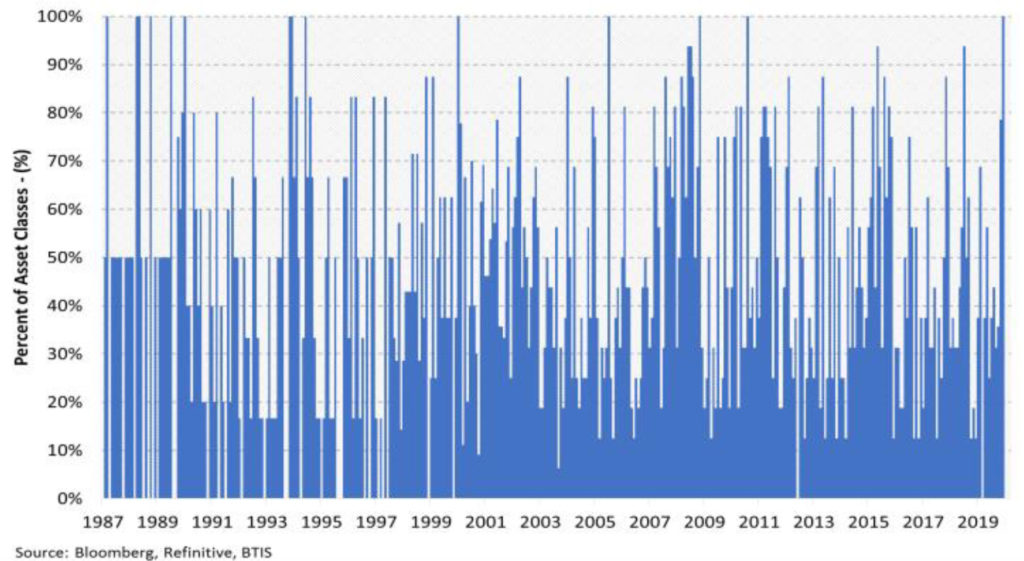

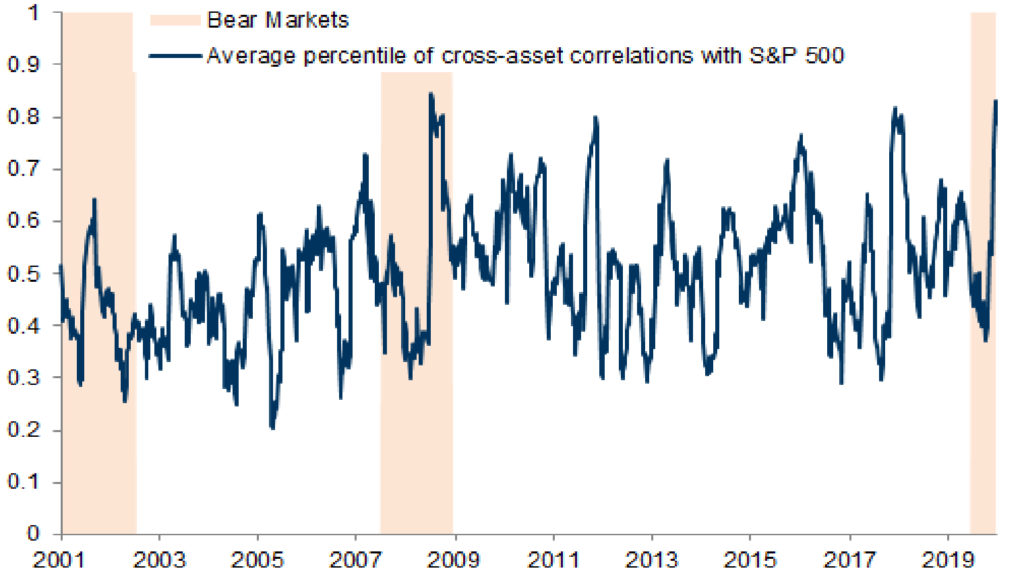

The sell-off has also seen some of the highest proportion of assets underperform cash on a monthly basis in over 30 years, and so has also been particularly challenging for multi-asset portfolios given the lack of traditional diversification from defensive assets (Bonds, Gold and the Japanese Yen have not provided their historical correlation benefits so far during this event). Investors have only experienced such a lack of diversification 13 other times considering data back to 1987. This has been triggered by the combination of an unexpected growth shock and a real yield shock, both additionally impacted by a sharp fall in energy prices which have destroyed what was a soft recovery of inflation expectations at the beginning of this year. The structural decline in inflation (and inflation volatility) of the past 30 years or more which also resulted in the decline in real yields, in turn had helped increase valuations across assets due to an intense search

Global Central Banks and Governments have mobilised to begin cushioning the expected downturn

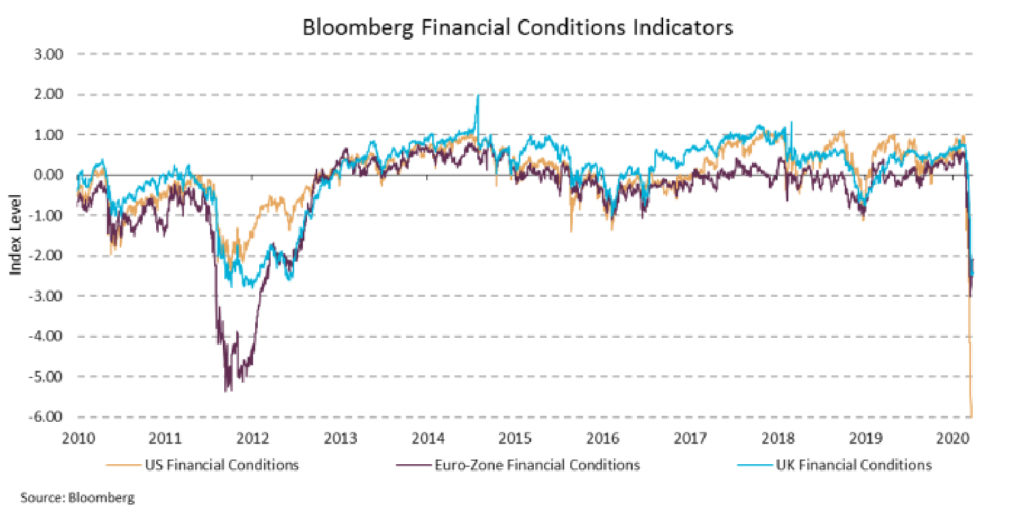

Globally, 19 countries have now announced complete lockdowns including Australia, India, U.K., the majority of the European Union, New Zealand and Poland. 5 states in the U.S. have closed their boarders so far with more expected2. Following restrictions on citizens, governments have mobilised significant and growing aid packages with the latest indications the U.S. is to support a spending package in the magnitude of nearly USD 2 trillion for financial support to both individuals and corporates. The substantial fiscal aid packages have also been supplemented by a slashing of cash rates and implementation of various forms of quantitative easing by Central Banks, including the RBA which has now guaranteed purchases for 3yr Bonds at 0.25%. The swift move in policy easing reflects the need to offset the significant and sharp deterioration in global financial conditions and activity.

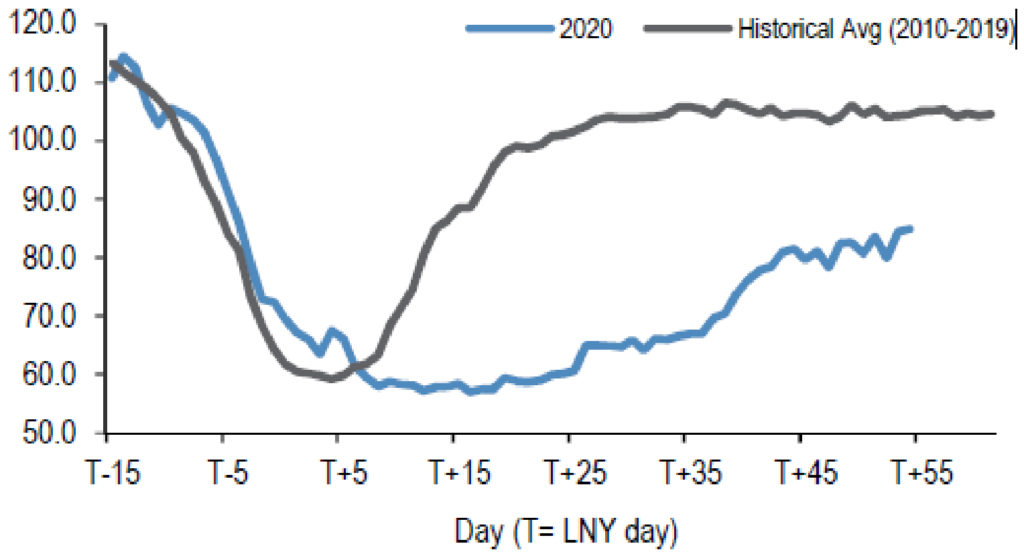

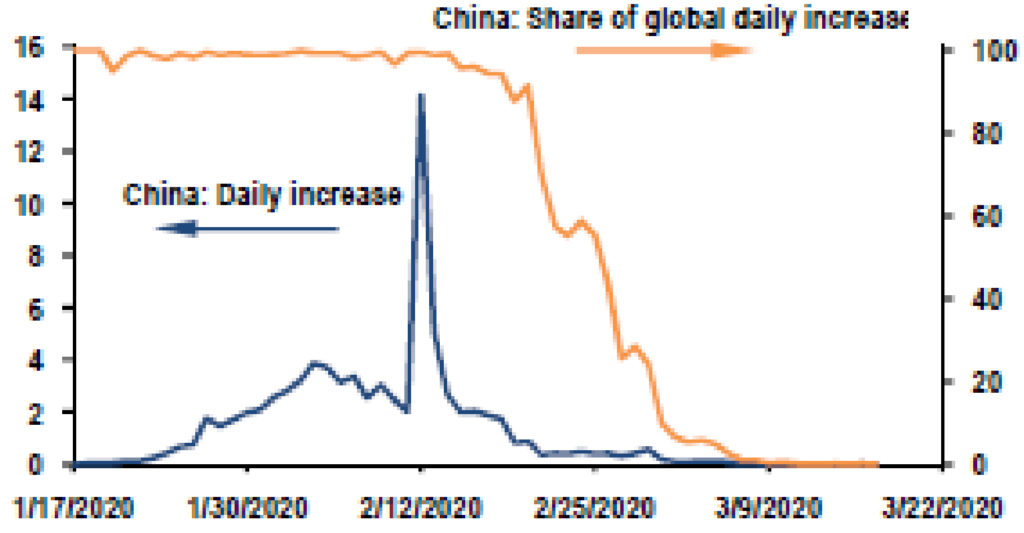

The reason for such significant policy measures has been to combat the massive shut down in economic activity enforced by governments in an effort to curtail the spread of the virus. A global recession for the first half of 2020 is now a foregone conclusion with estimates of global GDP contracting by up to 12% annualised3 being the largest fall in quarterly global activity in near 50 years. Unemployment is tipped to double to near 10% in Australia and over 6% in the US. Given the speed of change it is not illogical to believe that economic activity could also re-accelerate in a similar fashion leading to a ‘V’ shaped event. The speed and type of recovery however is likely to be significantly correlated to the duration of the current outbreak and how quickly it can be contained. The policy measures now being implemented will help soften the impact to economies and financial markets in the coming months. Considering the experience of China, the epicentre of the current crisis, active infections are now near one-tenth of their peak level considered to have been in late February/ early March. High frequency data also provides anecdotal evidence that China’s economic activity is beginning to return to normal levels following the sharp reductions in quarter 1. Whilst the rest of the world is now contending with containment of a pandemic, there is some evidence to suggest if contained, a recovery this year remains firmly possible.

Portfolio Implications

This is indeed a unique and unprecedented event. The pace of declines and speed in which economic activity has shutdown globally has seen short-term uncertainty rise to extremes which has manifested in giant price swings on financial assets. The announcements seen by policy makers over the past two weeks will provide significant support in cushioning the down-turn currently underway but short term uncertainty remains elevated for the coming weeks. For multi-asset investors a further challenge has been the level of indiscriminate selling over the past weeks which has seen little protection from asset diversification. Such dislocations however provide opportunities for long term investors to capitalise on. We continue to believe that the current episodic period in markets has provided opportunities across assets that are now being priced for distress and continue to remain fully invested at this time.